Hey everyone! We’re kicking off the new year with updates designed to make your HR and payroll tasks simpler than ever. These updates, as always, focuses on saving you time, reducing headaches, and making key processes more efficient.

From taking the complexity out of SOCSO calculations in Malaysia to streamlining OED submissions in Singapore, we’ve got some great updates to share that will make your work life a little easier. And, of course, none of this would have been possible without our incredible engineers--thank you for bringing these ideas to life! Let’s get to it!

A Quick Reminder: Talenox is ISO 27001:2022 Certified!

As you may recall, Talenox is proud to be ISO 27001:2022 certified! This isn’t just a badge; it’s a globally recognised standard that demonstrates our dedication to managing your sensitive information with the utmost care. We’re talking about keeping it confidential, ensuring its integrity, and making sure it’s always available when you need it. You can rest assured that we’re continuously improving our security measures to protect your data from evolving threats. Now back to the main updates!

SOCSO Contribution Updates: What You Need to Know

Big news for our Malaysian users! We know dealing with SOCSO can sometimes be a little tricky, so we wanted to highlight an important update regarding the wage ceiling.

The Change: The SOCSO wage ceiling has increased.

New Ceiling: RM6,000 per month (up from RM5,000)

Effective Date: October 1, 2024

What does this mean for you?

For employees earning RM6,000 or less: SOCSO will now be calculated based on their actual salary, using the standard SOCSO contribution rate table.

For employees earning over RM6,000: The SOCSO contribution will be capped at the RM6,000 level, ensuring compliance with the latest regulations.

Quick SOCSO Eligibility Breakdown:

Malaysian / PR (under 60): Employee pays 0.5%, Employer pays 1.75%

Malaysian / PR (60+) and Foreign Employees: Employee pays 0%, Employer pays 1.25%

This change helps ensure accurate SOCSO contributions for your employees, keeping you compliant and avoiding any potential issues.

Singapore Users: Submit OED to MOM Directly Through Talenox!

Great news for our Singapore customers! We’ve made it even easier to comply with MOM’s OED (Occupational Employment Data) submission requirements. You can now submit your OED directly through Talenox, saving you valuable time and effort.

What is OED, and why is it important?

OED helps MOM gather data about employment trends in Singapore. Submitting this information accurately and on time is crucial for compliance.

Here’s how simple it is to submit your OED in Talenox:

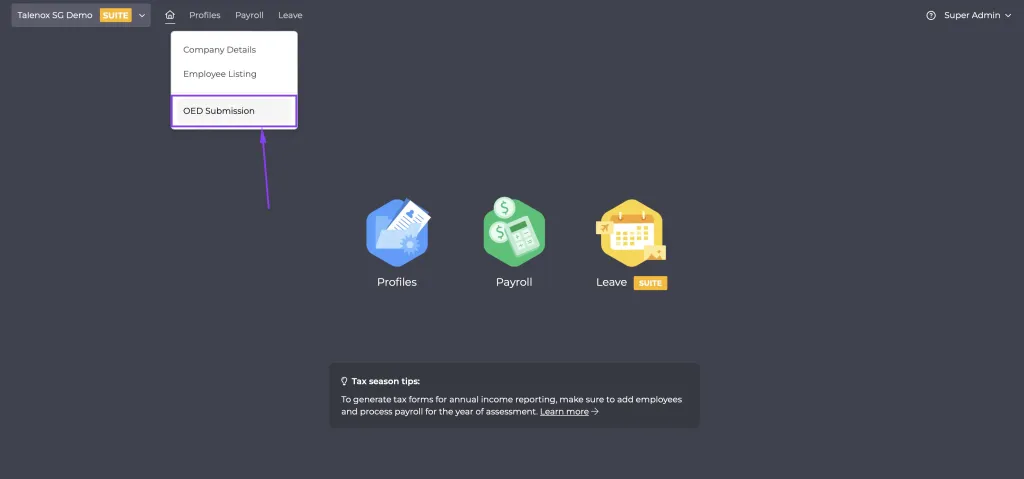

1) Go to Profiles and click “OED Submission”. You’ll find it right there in the menu.

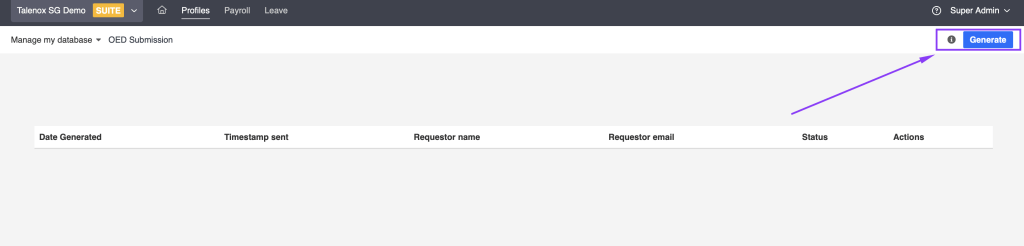

2) Click “Generate” to create a pre-filled Google Sheet. Talenox automatically pulls in the employee information you already have in the system, saving you tons of manual entry.

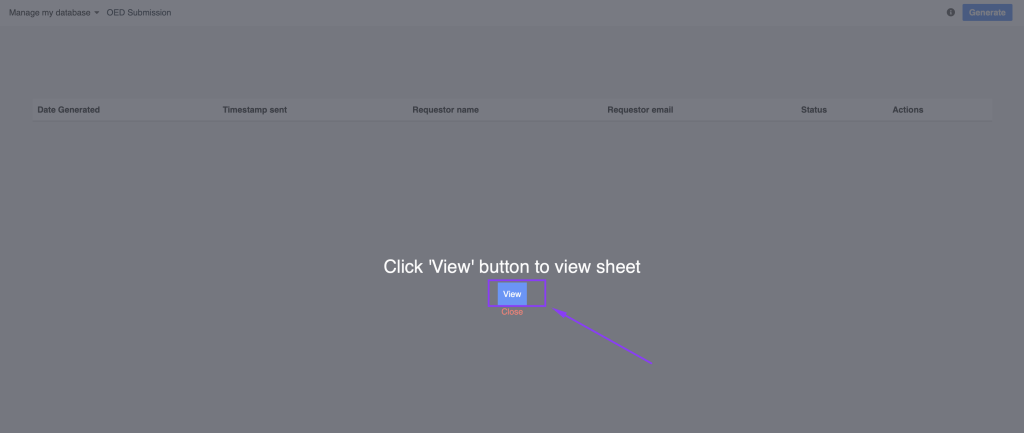

3) Once it’s generated, you can go ahead to review and complete the sheet. Don’t worry, it’s straightforward! Look for the small black triangles in the cells – they contain helpful tips to guide you.

Don’t worry, it’s straightforward! Look for the small black triangles in the cells – they contain helpful tips to guide you.

4) Click “Validate” then “Submit” to securely send the data to MOM. It’s a seamless process from start to finish!

Important reminders to ensure a smooth submission:

Before submitting, you must be assigned the relevant e-Services in CorpPass. Visit https://www.corppass.gov.sg/portal, search for “MOM,” and select Labour Statistics Survey Portal and myMOM Portal.

You’ll need “Manage” access in Talenox to view the OED submission page, as it contains sensitive salary information.

That’s a Wrap!

We hope these Q4 2024 updates make your HR and payroll tasks even easier, more efficient, and more secure. We’re always listening to your feedback and working to make Talenox the best it can be. Keep an eye on the blog for more tips, tricks, and updates!