Hello everyone, Talenox Updates Q4 2022 is here! Take a look at the latest updates that make Talenox an even smarter HR & Payroll Software. And it’s all thanks to our team of whip-smart developers.

1) Custom report by Cost Centres

We’ve just added a feature that generates Custom Payroll Reports according to Cost Centres in Talenox.

When creating a new Custom Report for the payroll month, you’ll now see the option to “Select employees:”.

The drop-down list for this section will allow you to filter this particular custom report according to the following options:

- All Employees (default)

- Any Cost Centre set up in your account

You can create and download a Custom Payroll Report by heading to Payroll > Payroll settings > Month Total > Export Bank File > Custom Report:

Learn how to create and customise your payroll reports in Talenox with this feature through the steps in this guide below.

2) Increase in CPF Contribution Rates (Singapore)

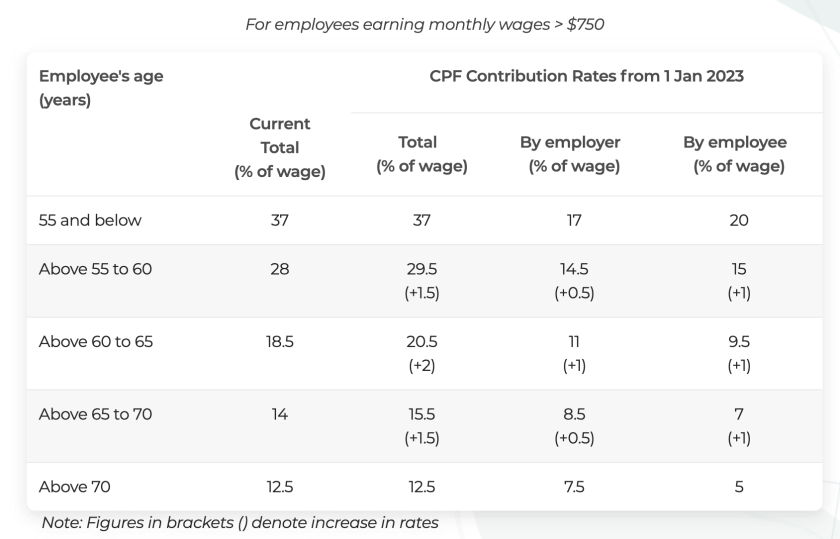

The Singapore government recently announced that the Central Provident Fund (CPF) contributions rates for employees aged above 55 to 70 will increase to strengthen their retirement adequacy.

The table below highlights the aforementioned changes, which will apply to wages earned from 1 January 2023 onwards (Source: CPFB):

Who will affected by these changes?

- Singapore Citizens & Singapore Permanent Residents (3rd year onwards)

- Employees aged above 55 to 70

- Employees earning monthly wages of more than $750

—–

Rest assured that Talenox has automatically updated our calculations rates in payroll for these contributions starting from 1st January 2023 (effective date) for your eligible employees.

For better clarity on the new rates, do refer to the complete CPF Contribution Rate Table for 2023 on CPFB’s website.

3) Individual Income Tax Rates Changes (Malaysia)

Malaysia’s Budget for 2023 (delivered on 7 October 2022) included individual income tax rate changes.

- Income tax rate for resident individual will reduce by 2% for the following chargeable income band:

- RM50,001 to RM70,000 (from 13% to 11%) and

- RM70,001 to RM100,000 (from 21% to 19%)

- The chargeable income band of RM250,001 to RM400,000 will combine with the RM400,001 to RM600,000 income band, subject to 25% tax rate

You can view the announced tax measures of the budget from the Budget Official Website here.

How does this affect Talenox?

Talenox Payroll PCB/MTD Calculations will update to incorporate these new rates into our system calculations for employees.

These updates will take effect from 1st January 2023 onwards.

4) Employment Act: Expanded Paternity and Maternity Leave Provision (Malaysia)

Maternity Leave Extended From 60 to 98 Days

Malaysia Maternity Leave entitlement has increased from 60 days to 98 days.

This applies to female employees who give birth after the 1st of January 2023.

How does this affect Talenox?

Effective from 1st January 2023, all new and existing Malaysia Maternity leave types using the default 60 days (entitlement before 2023) will update to 98 days automatically.

7 Days Paid Paternity Leave Introduced

Previously, Paternity Leave was not statutorily provided. Now, married male employees are entitled to 7 consecutive days of Paternity Leave following the birth of their child (limited to 5 confinement periods).

How does this affect Talenox?

Effective from 1st January 2023, Paternity Leave is added as a default leave type for all new Talenox Malaysia accounts created. Existing Talenox Malaysia account users will have to manually add “Paternity Leave” into the list of applicable leave types available to their male employees. This is to avoid any confusion among your employees in the meantime.