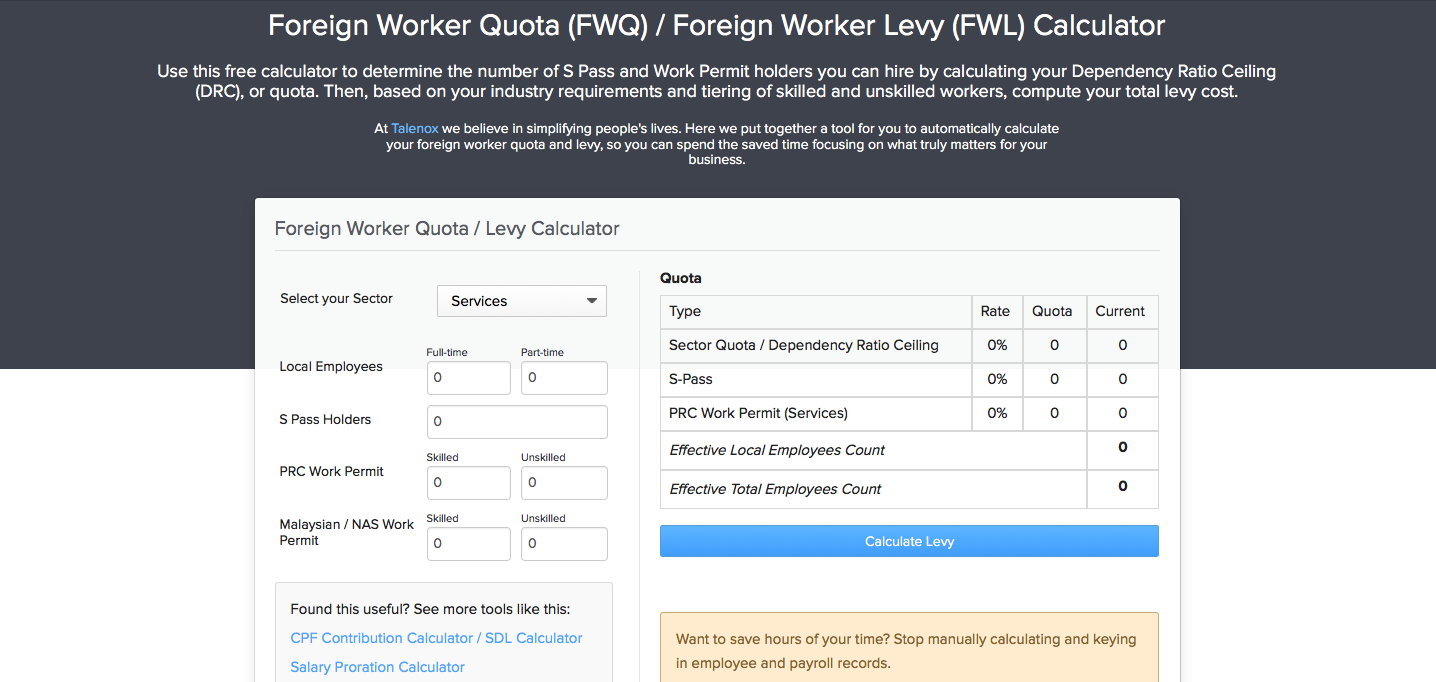

In case you haven’t already heard, we’ve built another free tool for local business owners. In view of the recent Budget 2015 foreign worker levy hikes, local companies must start planning and budgeting for their workforce capacity in the coming year. Hence, we built a very simple calculator to do just this. Presenting… Talenox’s very own Singapore Foreign Worker Levy Calculator / Singapore Foreign Worker Quota Calculator.

Who benefits from this calculator:

- Business owners in the Services, Construction, Marine, Process, or Manufacturing sectors

- Aspiring business owners in the Services, Construction, Marine, Process, or Manufacturing sectors

- HR managers / executives

What is the Foreign Worker Levy (FWL)?

The Foreign Worker Levy (FWL) is a pricing mechanism to regulate the number of foreign workers in Singapore. This applies particularly to companies which hire lower-skilled foreign workers, such as those holding Work Permits (WP) and S Passes. Companies which hire foreign workers will have to pay a monthly fee to the government, i.e. the levy, to keep these workers for hire. The foreign worker levy is calculated based on the foreign worker quota (see paragraph below).

What is the Foreign Worker Quota / Dependency Ratio Ceiling (DRC)?

The Foreign Worker Quota, also known as the Dependency Ratio Ceiling (DRC), is the maximum ratio of foreign workers that can be employed by a company. It is calculated based on the size of the local workforce in the company. Generally, the foreign worker quota for a given company would be higher if the number of local employees hired is larger.

How am I affected by this levy?

As long as your company falls under the Services, Construction, Marine, Process, or Manufacturing sector, you are required to hire within the quota and submit monthly levy payments for workers holding Work Permits (WP) and S Passes.

What about those on Employment Passes (EP)?

There is no ceiling on the number of Employment Pass (EP) holders that a company can employ, nor is there any restriction on the employee’s country of origin. Companies are not required to pay levies for EP holders.

How is the levy calculated?

- The sector type they are classified under

- The foreign worker’s qualifications (skilled or unskilled)

- The foreign worker quota, or dependency ceiling

To find out more about the detailed calculations, you may refer to MOM’s website.

How do I make payment?

There are seven ways to make payment, though I would highly recommend the first – GIRO.

- General Interbank Recurring Order (GIRO). Don’t have an account? Apply for one using this form.

- NETS

- Cash

- Cashcard

- Cheque

- Diners Club or D-Pay (at any AXS station)

- Internet Banking (via eNETS)

Alternatively, most companies would use a payroll software that calculates and pays the levy automatically, together with all other payroll calculations.

Do I need to pay CPF for foreign workers?

No. You only need to pay the monthly levies. However, if the foreign worker is subsequently granted a Singapore Permanent Resident (PR) status, you will need to start paying CPF for them. When this happens, you stop paying the levies.

What is the Foreign Worker Levy Waiver and am I eligible for it?

It depends. Just like any type of exemption/waiver, it only applies in specific situations, such as situations where your foreign worker is overseas for at least 7 days in a row, is hospitalised, or is serving National Service in his home country.

At Talenox, our vision is to design experiences for people first. We pride ourselves on creating products that are delightful to use. Since our inception, we have continuously strived to make painful Human Resource functions, e.g. payroll & leave management, easy to use. With a full self-serve platform, anyone (even non-HR professionals) can master using our online software. Get started with our 30-day trial now, with no strings attached.

If you found this calculator useful, you may want to check out our other two – CPF Contribution Calculator and Salary Proration Calculator.

You may also be interested in these readings:

Employers: Issue Itemised Payslips or Get Fined

Singapore Budget 2015 in 5 Minutes (Infographic)

ECF/SINDA/CDAC/MBMF Contribution 2015 and CPF contribution updates